Business

How Solicitors Make Bridging Loans Seamless: Unlocking Efficiency in Short-Term Financing

In the fast-paced world of real estate and finance, bridging loans have become an essential tool for individuals and businesses needing quick access to funds. These short-term loans are often utilized to “bridge” the gap between the purchase of a new property and the sale of an existing one, or when a quick capital injection is required. While bridging loans offer flexibility and speed, they also come with intricate legalities that need to be navigated effectively.

This is where solicitors come in. Acting as the linchpin between borrowers, lenders, and regulatory bodies, solicitors help make the bridging loan process seamless, reducing the stress and time associated with such transactions. This article will explore how solicitors ensure that bridging loans are processed smoothly, quickly, and with minimal friction.

The Role of Solicitors in Bridging Loans

When it comes to bridging loans, solicitors handle a variety of tasks that contribute to the efficiency of the process. Their legal expertise is essential in ensuring compliance, protecting the interests of both the lender and borrower, and speeding up the process.

1. Title Verification: Ensuring Legal Ownership

One of the first steps a solicitor undertakes is title verification. Before any loan can be granted, it’s critical that the property being used as collateral is free from any disputes, unpaid taxes, or legal claims from third parties. The solicitor thoroughly examines the property’s title to ensure it is clean and clear.

A clean title means the lender can feel confident that in the event of default, they can recover their funds by repossessing and selling the property without legal complications. This process mitigates risk and is fundamental to the success of any bridging loan.

2. Handling Complex Documentation: Minimizing Errors

The paperwork involved in a bridging loan can be daunting. From the loan agreements to the terms and conditions, all documents must be precise, error-free, and in compliance with current regulations. Solicitors act as gatekeepers of accuracy, ensuring every clause, condition, and requirement is legally sound.

Since many bridging loans involve high-value transactions and short timelines, any mistakes in the paperwork could delay the loan or lead to potential disputes down the line. Solicitors prevent this by overseeing every detail of the loan documentation and advising both the lender and borrower accordingly.

3. Managing Regulatory Compliance: Avoiding Pitfalls

Regulatory compliance is another crucial area where solicitors play a significant role. The legal landscape for financial transactions is complex and constantly changing. Solicitors ensure that the loan agreement complies with all applicable laws and regulations, whether it be regarding lending limits, interest rates, or consumer protection laws.

This protects both parties, as non-compliance can result in hefty fines, legal battles, or even the invalidation of the loan agreement itself. The solicitor’s role here is to navigate these legal waters, ensuring that both lender and borrower avoid regulatory pitfalls.

4. Fast-Track Conveyancing: Speeding Up the Process

In the world of bridging loans, speed is paramount. These loans are typically required in situations where funds are needed quickly, such as when a property is at risk of being lost to another buyer or when a business needs fast capital. One of the solicitor’s most important tasks is expediting the conveyancing process, ensuring that the transfer of property ownership is completed swiftly.

Traditionally, conveyancing can take weeks, if not months, to finalize. However, solicitors specializing in bridging loans understand the time-sensitive nature of the transaction and work to accelerate the process. By handling legal issues upfront, coordinating with relevant parties, and eliminating bottlenecks, they significantly reduce the time it takes to close a deal.

5. Securing a Legal Charge on the Property: Protecting the Lender

For lenders, security is the top priority when issuing a bridging loan. A legal charge on the property being used as collateral ensures the lender can recover their funds in case the borrower defaults. Solicitors handle the registration of this legal charge with the Land Registry, confirming that the lender has the first claim over the property.

This legal charge acts as a safety net for lenders, ensuring that their investment is secure. Solicitors not only register this charge but also ensure it complies with all necessary legal protocols, protecting both parties from future disputes.

6. Acting as an Intermediary: Smoothing Communication

One of the often overlooked roles of solicitors in the bridging loan process is their function as an intermediary. They facilitate communication between various parties involved, including the borrower, lender, brokers, and third parties like valuers or surveyors. By acting as a central point of contact, solicitors prevent miscommunication, delays, and misunderstandings.

Moreover, solicitors ensure that all necessary paperwork is shared and signed promptly. Their ability to streamline communication keeps the loan process on track and helps all parties work towards a common goal efficiently.

7. Handling the Disbursement of Funds: Ensuring a Smooth Transaction

Once the loan is approved and all legal checks are completed, the next critical step is the disbursement of funds. Solicitors manage this stage meticulously, ensuring that funds are transferred according to the agreed terms and that all parties receive their dues promptly.

A smooth disbursement process eliminates any potential delays in property purchases or other transactions requiring the loan. Solicitors ensure that once all conditions are met, the funds are released without unnecessary hold-ups, keeping the process fluid and seamless.

8. Facilitating Dispute Resolution: Avoiding Legal Battles

Although bridging loans are designed to be short-term and straightforward, disputes can occasionally arise. Whether it’s about the loan terms, repayment, or issues with the property, solicitors are instrumental in facilitating dispute resolution.

Their expertise allows them to mediate between the parties involved, offering legal solutions that prevent the escalation of issues. By resolving disputes quickly and amicably, solicitors keep the loan process moving, avoiding costly and time-consuming legal battles.

9. Supporting the Exit Strategy: Planning for Loan Repayment

A crucial aspect of bridging loans is the exit strategy—how the borrower plans to repay the loan. Whether the borrower intends to sell the property, refinance, or secure long-term financing, the solicitor plays an advisory role in ensuring that the exit strategy is both viable and legally sound.

Solicitors help draft or review contracts and agreements related to the exit strategy, ensuring that the borrower’s repayment plan is clear and enforceable. This provides reassurance to the lender, who is depending on the borrower’s ability to meet the repayment terms.

The Benefits of Solicitor Involvement in Bridging Loans

Solicitors provide invaluable expertise that helps bridge the gap between lenders and borrowers, enabling a smoother, more efficient process. Some of the key benefits include:

- Reduced Risk: Solicitors minimize the risk for lenders by ensuring that legal checks are thorough and property titles are clear.

- Faster Processing: With solicitors managing complex documentation and fast-tracking conveyancing, the time to complete the loan process is shortened.

- Legal Compliance: Regulatory oversight by solicitors ensures that the loan agreement complies with all legal requirements, protecting both parties.

- Clear Communication: Solicitors act as intermediaries, making sure that all parties are kept in the loop and that any misunderstandings are promptly addressed.

Conclusion: How Solicitors Make Bridging Loans Seamless

In the high-stakes environment of real estate and short-term financing, bridging loans are essential for unlocking opportunities quickly. However, without proper legal guidance, these loans can become complicated and fraught with risk. By involving a skilled solicitor, both borrowers and lenders can rest assured that their transactions will be handled professionally, efficiently, and with minimal friction.

From title verification to regulatory compliance, fast-tracking conveyancing, and managing communication, solicitors play a pivotal role in ensuring the success of bridging loans. Their expertise makes the entire process seamless, allowing clients to focus on what really matters—securing their next investment opportunity.

Business

Why Is It So Important To Get An Audience With The King In Path Of Exile 2?

For players familiar with POE 2, they all know that even if they reach the end of the game, it does not mean that they have achieved the final victory. There is still a bigger challenge waiting for players after the end, that is the pinnacle boss. For players, the most important boss is Ritual pinnacle boss – King in Mists. Players can not only earn POE 2 Divine Orbs by grinding it, but also get valuable rare loot.

However, this is very challenging because players need to obtain a unique rare item – An Audience With The King, which is not only very difficult to obtain, but also the process of obtaining it is extremely boring, requiring players to invest a lot of time and effort. Players can obtain it through Ritual Altars or trade with other players.

Ritual Altar

In fact, An Audience With The King is a reward in Rituals, and the probability of appearing is also very small. Players can obtain it by trading tribute. Generally speaking, it often appears on low-tier maps, and if An Audience With The King does not appear, players can re-roll the reward pool, but this requires 1000 Tributes. What’s more important to note is that in order to get it, 2500-7000 Tributes are required, which is really a huge challenge for players.

In addition, players should be reminded not to spend too many favors before completing all rituals on the map and re-rolling the reward pool. In most cases, players can delay items by using Defer button, which ensures that they will appear in the next ritual node. Moreover, it is only a small part of the total price of the item, and the delayed payment will only be made when the item appears. Although it may not appear in the next ritual, it will definitely appear in the end.

The value of the item is also positively correlated with the time required to return. The higher the value, the longer it takes to return. As the most valuable item in the reward pool, players need to have enough patience and time to get An Audience With The King.

Generally speaking, delaying an item once is not enough. When An Audience with the King reappears, the player must again hold off until its price is no longer a burden to the player, so that they can acquire it through trade. Players must clear ten ritual maps to hone its base cost.

Of course, if players encounter An Audience With The King, which is very expensive and they do not have enough grace to postpone it, please give up immediately, otherwise all efforts will be in vain.

Trade Method

In fact, the easiest way to get An Audience With The King is to trade. If players get extra currency through various methods, you can trade directly with the official website or Currency Exchange, but in order to prevent scams, it is recommended that players use Currency Exchange.

Items in POE 2 generally do not have a fixed price because it is subject to market fluctuations, but as a rule of thumb, An Audience With The King usually hovers around 5-10 Divine Orbs, and players can measure it themselves based on this price.

How To Farm An Audience With The King?

The most important thing to farm An Audience With The King is to get Ritual Precursor Tablets, which are a special variant that can only be dropped from Ritual Altar-spawned monsters. If they are placed in a cleared Tower, the regular map nodes around the tower will become ritual map nodes.

Players can get Ritual Precursor Tablets from trading sites or trading channels. One of its good modifiers is that the altar in the map allows additional re-rolls of favors.

Essentially, An Audience With The King is not a dropped item, but a random spawn in the store. Because it is one of the few items that can benefit from the increased attributes of the dropped item rarity, it is different from other things.

Use Or Sell?

As an item that is very expensive in itself, if players do not have enough confidence and a strong build to defeat King in Mists, they can choose to sell An Audience With The King, which will not only get extra POE 2 Currency, but also will not waste the value of the item itself. Many players have successfully become rich in this way.

Of course, using it is a better choice, because if the player successfully defeats the boss, he will get the most valuable loot in the game-Ingenuity Utility Belt and From Nothing Diamond.

Although it is difficult to get An Audience With The King, as long as players carefully observe the situation in the game and make the right decisions, I believe they can get the items they want and win in the end!

Business

Exploring the Rejuvenating Power of Wellness and Health Retreats

In today’s fast-paced world, where stress and burnout seem unavoidable, wellness and health retreats offer a peaceful escape. These sanctuaries of calm and well-being provide not just rest, but an opportunity to rejuvenate mentally, physically, and emotionally. Imagine waking up to the serene sounds of nature, engaging in mindful yoga, and savoring nutritious meals designed to enhance your body’s natural vitality. With their rising popularity, more people are seeking the healing benefits that come with wellness retreats, which can be especially rejuvenating in places like Florida.

The Growth of Wellness Retreats in Florida

Florida, with its natural beauty and warm climate, has long been a popular destination for those seeking rest and relaxation. The state offers a diverse range of wellness and health retreats that cater to different needs. From beachfront resorts with yoga practices to holistic healing centers nestled in nature, Florida has something for everyone. Florida’s 2024 Legalization Vote has further shaped the wellness landscape in the state, providing a fresh avenue for people to explore health and wellness through more natural, alternative methods. As the state moves toward the legalization of certain wellness practices, retreats are becoming even more innovative, incorporating the latest treatments in wellness into their offerings.

The tropical allure of Florida plays a significant role in its attraction as a wellness destination. Imagine spending your mornings practicing yoga on a quiet beach, the sound of the ocean waves soothing your soul, and the endless sunshine providing a boost to your mood. Such retreats are designed to foster mental clarity, emotional balance, and physical well-being. The combination of holistic practices, healing environments, and nutrient-dense foods creates the perfect backdrop for individuals seeking a break from the stresses of everyday life.

Transformative Benefits of Wellness Retreats

Whether it’s through yoga, meditation, or nutrition-focused programs, wellness retreats provide a variety of ways to nourish your mind and body. Many retreats incorporate spa services, detoxification programs, and fitness classes, all with the aim of restoring your body’s natural balance. Participants often return home feeling reinvigorated, with a renewed sense of peace and vitality.

One of the most significant benefits of wellness retreats is the opportunity to disconnect from the digital world. In our modern lives, where we’re constantly connected to our phones, emails, and social media, it’s easy to feel overwhelmed. Wellness retreats offer the chance to unplug from the distractions of technology and reconnect with nature. In a world that’s becoming increasingly fast-paced, Florida’s 2024 Legalization Vote may just lead to even more therapeutic options for detoxing from digital overload, bringing people back to their roots.

Wellness Retreats for Mental Health

Mental health is one of the core pillars of wellness. In recent years, retreats focusing on emotional healing and mental clarity have gained immense popularity. Wellness centers in Florida offer specialized programs to help guests deal with stress, anxiety, and other mental health challenges. These retreats use mindfulness techniques, such as guided meditation, breathwork, and deep relaxation exercises, to help individuals manage their mental well-being.

The calming surroundings of Florida’s pristine beaches and lush landscapes provide the perfect environment for people to reset their mental state. A change of scenery combined with focused mental health practices can allow guests to detach from the daily grind and re-establish emotional equilibrium. Florida’s 2024 Legalization Vote may play an instrumental role in expanding mental health therapies, offering new, research-backed modalities that integrate seamlessly into the wellness and health retreat experience.

The Physical Rejuvenation Journey

While mental wellness is an essential aspect of retreats, physical rejuvenation plays an equally vital role. Many wellness retreats in Florida focus on improving fitness and physical health through a variety of fitness programs. These may include yoga, Pilates, strength training, or even outdoor activities like hiking or kayaking. Fitness-oriented retreats are ideal for individuals looking to improve their overall health while enjoying the natural beauty of Florida.

Florida’s idyllic weather makes outdoor activities a core part of many wellness retreats, whether you’re practicing yoga on the beach or taking part in a hiking excursion through the Everglades. Engaging in physical activities in such beautiful environments helps boost serotonin and dopamine, which are the body’s natural “feel-good” chemicals. Moreover, eating healthy, locally-sourced foods tailored to individual dietary needs enhances the physical benefits of the retreat. Whether it’s detox programs or customized fitness regimens, Florida’s retreats offer various ways to get fit while relaxing in paradise.

Holistic Healing: Embracing a Mind-Body Connection

Holistic healing is at the heart of most wellness retreats, and Florida offers some of the most innovative holistic programs in the country. These programs emphasize the mind-body connection, utilizing a range of treatments such as massage therapy, acupuncture, and aromatherapy. Holistic healing encourages individuals to take care of their emotional, mental, and spiritual well-being, often incorporating mindfulness practices with physical treatments.

Many Florida retreats also include workshops and talks on how to incorporate holistic practices into everyday life, making the benefits last long after the retreat ends. The state’s welcoming environment and emphasis on overall well-being make it an ideal location for holistic health retreats. Whether you’re interested in spiritual healing, acupuncture, or energy work, Florida has an abundance of retreat options that cater to your specific needs. Furthermore, Florida’s 2024 Legalization Vote could signal an influx of even more alternative wellness treatments in the near future, allowing retreat centers to offer an even broader range of services.

A Lasting Impact

The transformative nature of wellness retreats often leaves guests with life-changing results. Many individuals report long-term benefits, including reduced stress levels, improved sleep, better relationships, and a more balanced perspective on life. The deep sense of relaxation and healing achieved during a retreat becomes a touchstone for future personal growth. In addition, the commitment to living a more mindful, healthy life after the retreat continues to benefit participants for years to come.

By addressing the physical, emotional, and spiritual aspects of health, wellness retreats empower people to create lasting changes in their lives. Guests often find themselves adopting more mindful eating habits, incorporating fitness routines into their daily lives, and cultivating emotional resilience long after they’ve left the retreat. With the natural beauty of Florida as a backdrop, these retreats help individuals connect with their higher selves and set new intentions for their personal wellness journey.

When it comes to choosing a wellness retreat, Florida stands out as one of the top destinations for those seeking a holistic escape. The combination of pristine landscapes, warm weather, and a growing emphasis on health and wellness makes the state an ideal place to unwind and rejuvenate. With Florida’s 2024 Legalization Vote potentially ushering in new wellness practices, the future of health retreats in Florida looks brighter than ever. Whether you’re interested in mental clarity, physical rejuvenation, or holistic healing, Florida’s wellness retreats offer something for everyone looking to enhance their well-being.

FAQs

1. What types of wellness retreats are available in Florida? Florida offers a wide variety of wellness retreats, including those focused on yoga, fitness, holistic healing, detoxification, and mental health. There are options for every type of wellness journey, from luxury resorts to eco-friendly retreats.

2. How can wellness retreats benefit my mental health? Wellness retreats can help reduce stress and anxiety through mindfulness techniques such as meditation and breathwork. The tranquil environment and focus on mental well-being allow guests to disconnect from daily stressors and reset their emotional health.

3. Are wellness retreats in Florida all-inclusive? Many wellness retreats in Florida offer all-inclusive packages, which may include meals, accommodations, spa treatments, and wellness activities. Be sure to check the specifics of each retreat to understand what is included in the package.

4. What are the benefits of choosing Florida for a wellness retreat? Florida offers a unique combination of natural beauty, warm weather, and diverse wellness practices. Whether you’re looking for a beachside retreat or a holistic healing center in the heart of nature, Florida provides the perfect environment for relaxation and rejuvenation.

5. Will Florida’s 2024 Legalization Vote affect wellness retreats? Yes, the potential legalization of certain wellness practices in Florida could lead to more innovative and diverse health services offered at retreats, such as alternative therapies and treatments. This will enhance the wellness experience for all visitors to the state.

Business

Top Security Camera Systems for Small Businesses

Every small business must prioritize security. The fitting surveillance system is a simple yet effective means to discourage crime. It watches after your people and assets at the same time. A professionally selected security camera system improves the safety of the business you run. It assures you that your business is under watchful eyes, even if you are away. Various excellent options serve distinct needs. This guide presents the best security camera systems for small enterprises. Each has unique perks, such as advanced features, easy use, and scalable options. Careful choice can help you choose a system exactly fit for the business’s needs. It guarantees complete peace of mind and security.

Ring Stick Up Cam

Businesses looking for installation flexibility would find great value in the Ring Stick-Up Cam. Its simple construction lets you almost place it anywhere—inside or outside. Clear footage from the 1080p HD video means that you won’t miss any detail. Two-way communication allows you to interact with people around the camera, therefore enhancing security.

Its motion sensors let you know about any strange activity. This camera also fits other Ring products, therefore establishing a consistent security mechanism. Whether you own a café or a small business, the Ring Stick Up Cam provides consistent, easy-to-use, reasonably priced security.

GW Security Camera Systems: High-Performance Solutions for Small Businesses

High-end security camera systems meant to provide small companies with dependable monitoring and sophisticated security capabilities are offered by GW Security. GW Security cameras guarantee crystal-clear video and accurate alerts by means of its innovative 4K Ultra HD resolution and artificial intelligence-powered motion detection, therefore lowering false alerts.

Their solutions let companies keep real-time monitoring of their premises by including remote access via mobile applications, night vision capabilities, and weatherproof outside cameras. Furthermore, by offering NVR (Network Video Recorder) systems with high storage capacity, GW Security guarantees continuous recording free from data loss.

Small companies looking for a professional-grade security solution without the high expenses of enterprise-level systems will find GW Security to be a great alternative thanks to scalable options and easy installation.

Arlo Pro 4

Imagine a camera system that offers freedom without skimping on quality – that’s Arlo Pro 4 for you. Its completely wireless setup allows you to install it anywhere without being troubled by cords. Even more, its 2K video resolution promises sharp and clear recordings. Using the built-in two-way audio feature, have a conversation with your guests or any invaders; it’s like having virtual guard duty!

The motion detection notifications will send straight to your phone real-time information. Plus, the night vision feature ensures your space stays monitored even when the lights go out. For those after flexibility paired with excellent performance, look no further than the Arlo Pro 4.

Amcrest 4MP Outdoor Security Camera

Opt for the Amcrest 4MP Outdoor Security Camera if you require a strong and weatherproof solution. It’s built to brave the outdoors while delivering impressive clarity with its 4MP resolution. Even in pitch darkness, its robust night vision guarantees all activity is overseen up to a stunning distance.

The capability to pan, tilt, and zoom means you can alter your viewing angle for broader coverage and more detailed perspectives. Footage storage poses no issue as this camera offers flexibility with local and cloud storage possibilities. The enduring design, coupled with superior features, makes the Amcrest 4MP an excellent option for businesses wanting solid outdoor surveillance.

Blink Outdoor

Looking for a good outdoor camera that doesn’t hurt your wallet? Consider the Blink Outdoor! This weatherproof cam perfectly secures your outdoor spaces. Its wireless design makes the setup super easy and flexible. Even at night, its infrared night vision ensures you see clearly in the dark. Saving battery life isn’t a problem either, thanks to its amazing battery efficiency.

With remote access via the Blink app, you can monitor your property anywhere. If you’re after decent quality surveillance that won’t break the bank, the Blink Outdoor is a fantastic choice for added peace of mind outside your business.

Conclusion

Selecting the appropriate camera system improves your business security rather noticeably. Ideal choices like Ring Stick Up Cam and Blink Outdoor make setup and use easy while offering great protection. For those desiring sharp images, the Amcrest 4MP Camera is excellent. It ensures strong outdoor surveillance. If flexibility is your need, the Arlo Pro 4 fits perfectly. On the other hand, the Lorex NVR System serves large coverage well. Each of these systems has distinct benefits catering to varied requirements. Selecting what suits you best delivers reliable security that guards your assets around the clock and offers tranquil mind assurance.

-

Business11 months ago

Business11 months agoIs Bolt Cheaper Than Uber? Comparing Ride-Hailing Prices and Services

-

Celebrity9 months ago

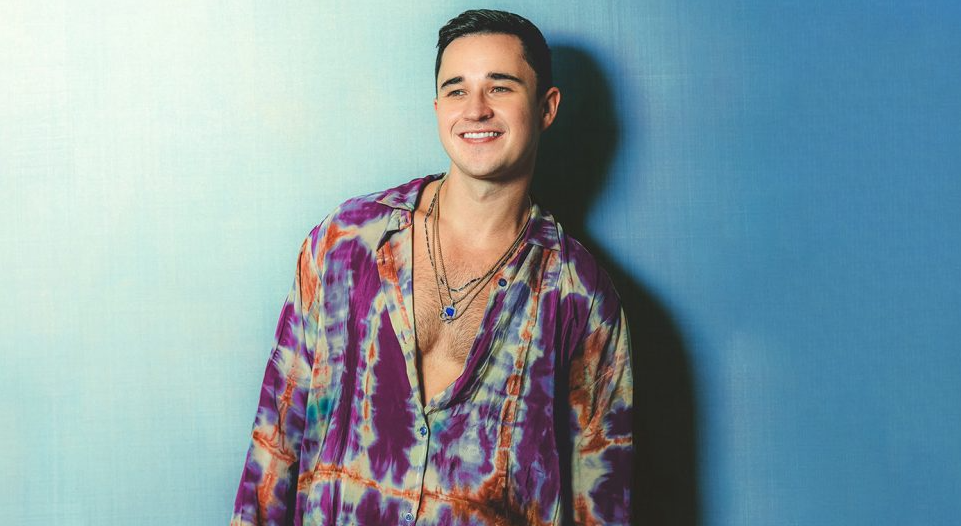

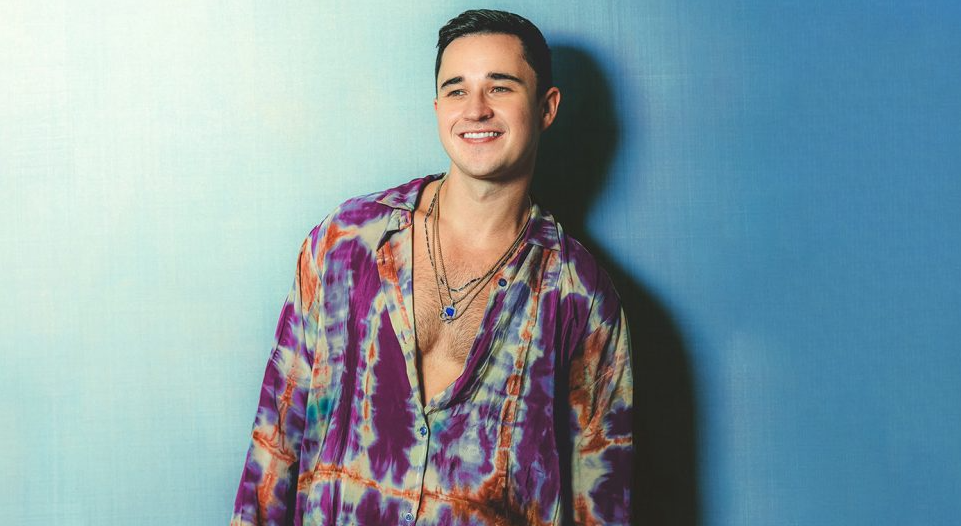

Celebrity9 months agoBailey Zimmerman’s Net Worth in 2024: A Look at His Earnings

-

Celebrity10 months ago

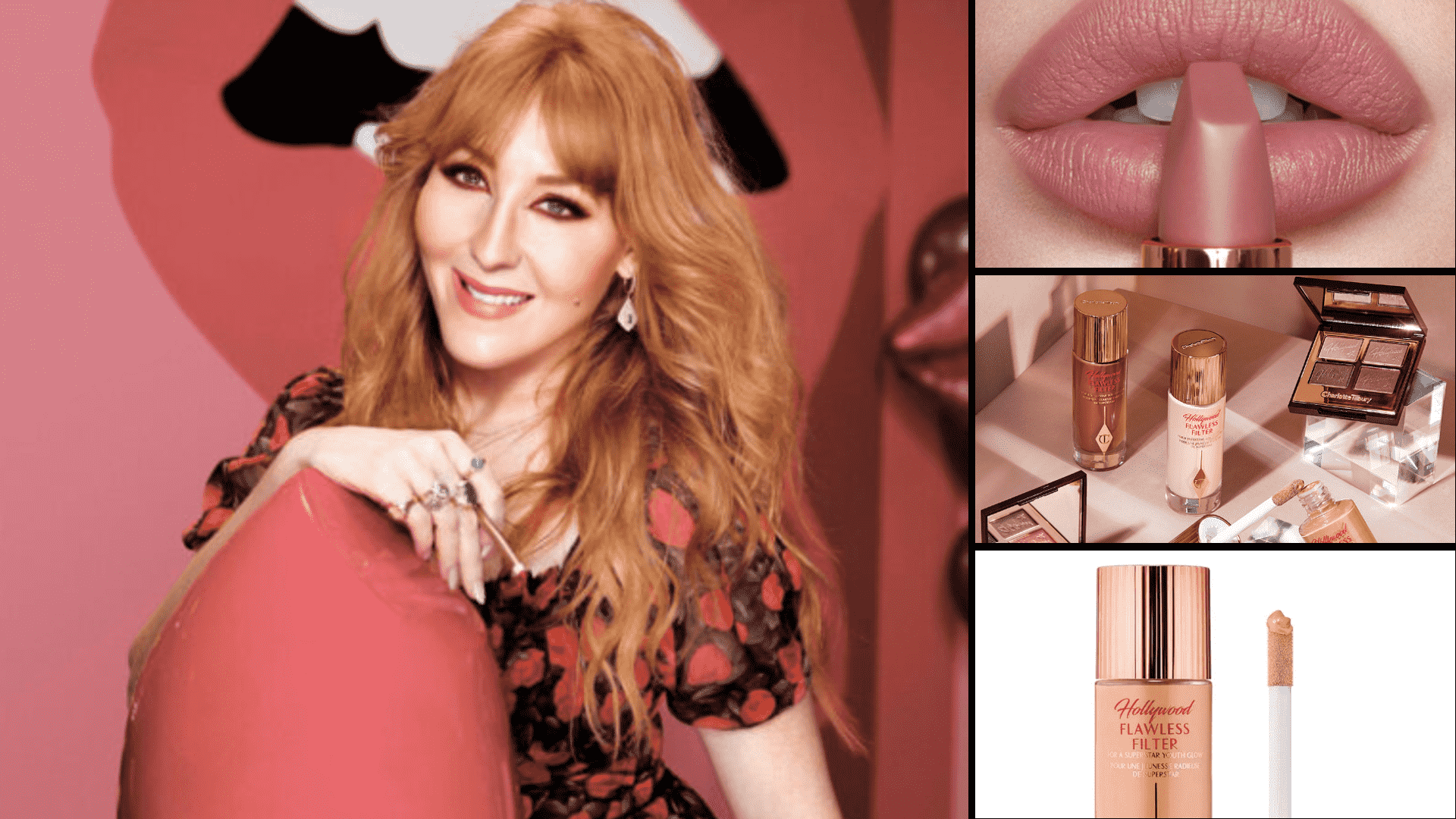

Celebrity10 months agoWho Is Charlotte Tilbury: The Visionary Behind a Global Beauty Empire

-

Fashion6 months ago

Fashion6 months agoHow to Choose the Right Shade of Green for Your Skin Tone

-

Technology8 months ago

Technology8 months agoZoechip: Your Ultimate Guide to Streaming Movies and TV Shows Online

-

Sports8 months ago

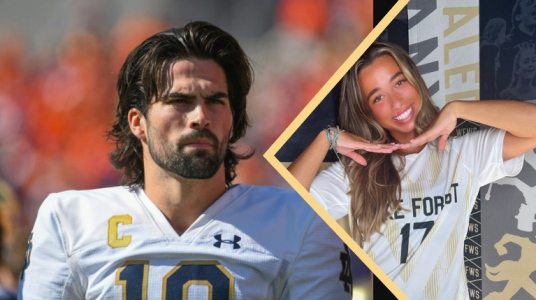

Sports8 months agoWho Is Tyla Ochoa? All About Sam Hartman’s Girlfriend – Family, Career, and Personal Life

-

Celebrity9 months ago

Celebrity9 months agoCaseOh’s Financial Success in 2024: Net Worth, Income Streams & More

-

Celebrity10 months ago

Celebrity10 months agoJohn Summit Net Worth: A Rising Star in the Music Industry